Opportunity market, but rise in values trending down

In Running Your Business

Follow this topic

Bookmark

Record learning outcomes

Banks still see pharmacy as a positive funding opportunity, but some have inevitably adapted their lending parameters in recognising the challenges the sector has been facing over recent years, reports Christie & Co in its 2019 Pharmacy Market Review.

Initial reaction to the five-year funding deal in England in the lending market has been one of cautious optimism, says Christie Finance, who suggests it is important that pharmacy operators and potential new buyers looking for funding fully understand the impact the settlement may have on a business’s future performance, given the changes to come over the next five years, some of them as yet unquantified.

Close scrutiny

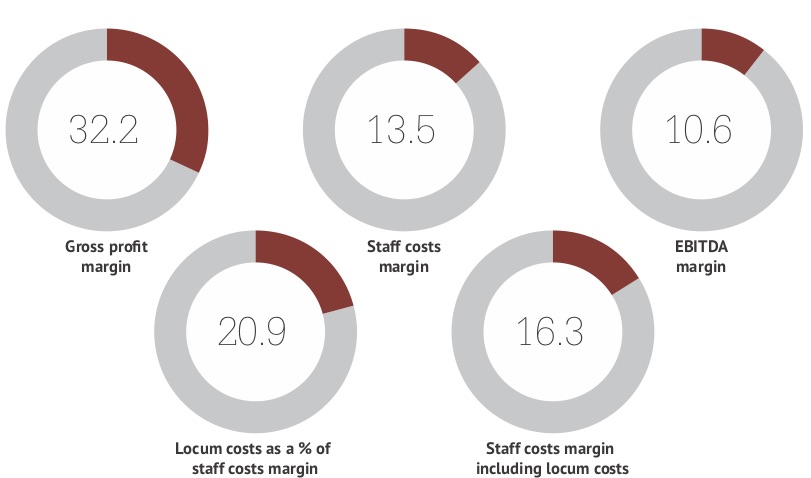

The group says that as with other sectors, the banks will be closely monitoring trading performance (a snapshot of average trading metrics for pharmacies across the UK is shown in Figure 1, data extracted from valuations and sales undertaken by Christie & Co over 12 months), particularly where they have existing funding arrangements with multiple and group operators. “Should these edge closer to agreed covenants they may look to the operator to consider restructuring the debt either through a cash injection, disposal of non-performing assets, or considering refinancing opportunities,” the Review says.

Recent years have seen an increase in demand for flexible funding in the sector arising from cash flow pressure. Unsecured loans and equipment finance have proved popular given the additional flexibility afforded, Christie Finance concludes.

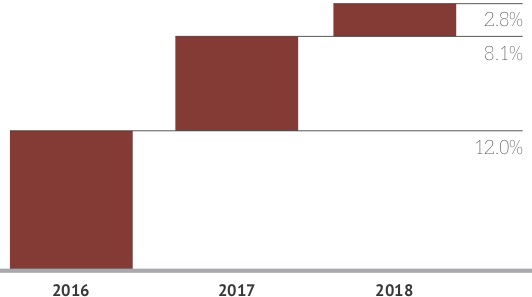

On price trends, Christie & Co says growth in the average price paid for pharmacies (Figure 2) has continued to slow, down from 8.1 per cent in 2017 to 2.8 per cent in 2018. As the news pages have shown, the appearance on the market of smaller pharmacies is in part attributed to multiple operators looking to dispose of non-performing or marginal assets, although Christies also notes that some independents have taken the opportunity to exit on the back of the strong values being achieved. The firm’s 2020 Business Outlook Review due out in the New Year could make for interesting reading.

Taken together Christie & Co says that appetite has continued to support EBITDA (earnings before interest, tax, depreciation and amortisation) multiples ranging from 7.5-10 for standard hours contracts. The position was stronger in Scotland, where a more settled funding landscape and scarcity of stock contributed to EBITDA multiples of nine to 11 times for high quality pharmacies.

Independent demand

On the demand side, the company says 90 per cent of the applicants on its national database are either first time buyers or independent contractors, although 54 per cent of agreed sales in the year up to the Review’s publication were to multiple operators, with 32 per cent to first time buyers.

With demand from the same quarters, 2019 was trending similar to 2018, with the larger operators concentrating on consolidating their estates. Christie & Co noted a slight reduction in applicants before the five-year deal was announced.

During the past year, the company had valued, appraised or sold around 700 pharmacies with a combined value in excess of £515 million.