A little pick me up?

In Healthy living

Follow this topic

Bookmark

Record learning outcomes

P3 speaks to a selection of brands in the vitamins, minerals and supplements market, to see how their products are performing. Is the category on the rise for pharmacy?

Many community pharmacies are reporting that the vitamins, minerals and supplement category is popular with their customers and is selling well, better than in previous years.

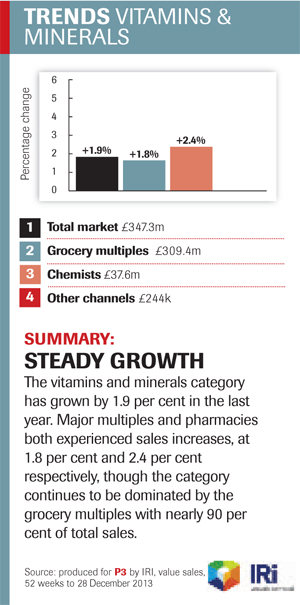

Data from market analysts IRI suggest that growth is currently the fastest in community pharmacy, although sales still remain 10 times larger in grocery multiples and health and beauty multiples. The data suggest that value sales have increased by 1.9 per cent over the past 12 months. However, Kantar Worldpanel, suggests that the value of the supplements market is down five per cent year on year with 99.4 million pack sales. Collectively, own-brand sales lead the sector.

Headlines relating to vitamins and supplements have been in the national press in recent months, with several stories casting doubt on the efficacy of supplements. The Daily Mail may have alarmed users of vitamin E supplements by linking them to prostate disease, and despite reports over the past few years of a resurgence in conditions such as rickets, vitamin D supplements were declared 'useless' by a US doctor in February. But despite ongoing debate about the science in the general media, customers seem are keener than ever to pop a vitamin pill.

New sector for heart health

The VMS sector is 'booming', according to brand experts at MegaRed, RB's first launch into the sector. The team has ambitious plans for UK growth and this includes a focus on an audience not traditionally targeted for heart health supplements €“ women.

'Our aim is for MegaRed to deliver £23 million sales value to the category in the next three years. The VMS category is growing strongly globally, driven by high consumption and spend per shopper. Currently fish oils and omega-3 products dominate the UK market.'

The new RB UK campaign to support MegaRed aims to grow this market further by encouraging women to take the supplement to support heart health. 'Traditionally this has been led by targeting a largely male 45+ audience, but it is an issue for both men and women and this is an important point of education.'

Their research suggests that consumers are looking to buy more condition-specific products. For example, whether it's down to recession, bad weather at the beginning of the year or winter blues, the stress supplements category reportedly had a strong start to 2014 €“ up nine per cent in January.

Consumers are also seemingly prepared to invest in more expensive combination products designed to 'boost energy' or 'improve cardiovascular health and joint health'.

Vitamin D campaign

An optimistic view for the market comes from Andrew Thomas, managing director and founder of BetterYou. He tells P3 that there is plenty of activity in the category. 'Growth in the supplement market is quoted at about 16 per cent year on year. But this is like-for-like growth and belies the dynamism of new product development. There is a hunger for products that provide clear information, innovation and supporting research.'

Manufacturers should not forget the importance of communicating the features of a good quality product to customers, he says. 'The tremendous increase in information availability has led to the public asking more questions and expecting a better quality of answer where food supplements are concerned. Food supplements have to earn their place on the pharmacist's shelf.'

Manufacturers should not forget the importance of communicating the features of a good quality product to customers, he says. 'The tremendous increase in information availability has led to the public asking more questions and expecting a better quality of answer where food supplements are concerned. Food supplements have to earn their place on the pharmacist's shelf.'

Greater awareness from the public of the role that specific vitamins play has contributed to this rise, he says. Growth in overseas markets, including central and eastern Europe, Scandinavia and South Africa, have also been important for the company.

BetterYou has been working with the NHS to understand more about people's vitamin D levels €“ offering its blood-spot vitamin D home testing service in conjunction with Sandwell and West Birmingham NHS Trust. Birmingham has been leading the way in promoting awareness about necessary levels of vitamin D.

The company is a founding member of the Vitamin D Mission (www.vitamindmission.co.uk), which aims to eradicate vitamin D deficiency in the UK's under-fives.

'The British weather is robbing your child of vitamin D, says the campaign. While one egg or a child-sized bowl of cereal contains about 1mcg of vitamin D, the average child needs a daily dietary vitamin D intake of about 7mcg per day, regardless of how much sunshine they soak up.

A new range of children's vitamin D oral sprays will be launched by BetterYou in the next few months: DLuxInfant, with 300iu of vitamin D, is suitable for children from birth and DLuxJunior, with 400iu of vitamin D, is suitable for children over five years.

Brand developments

Probiotics is an area of the supplements market that has seen improved sales in recent years. In particular, the Bio-Kult brand reports that it has seen double-digit sales growth over the past three years. Probiotics International says it has increased resources to keep up with demand. 'I believe that growth is being driven by increased awareness,' says Lauren Lemmer from Bio-Kult. 'Education, customer testimonials and supporting evidence through research have also been key.'

Bio-Kult is due to launch a new product in the range, to appear first at the Natural and Organic Products Europe trade exhibition this month. 'If you can't make the date, details will be on the Bio-Kult website, too,' says Ms Lemmer.

She suggests that probiotics should be offered alongside antibiotics to replenish the good bacteria in the gut.

There's also good news from iron supplement Spatone, which also reports increased sales. Ngaire Mitchell, Spatone's brand manager, points to past slow growth of the VMS market in the UK, which she attributes partly to a previous lack of significant new product development in the market. Spatone is said to have grown by six per cent in value sales in the year to February.

To attract the active youth market, the brand is launching the Spatone Sports Pack. The pack will be aimed at athletes who want to keep up with their training programmes by ensuring they maintain optimal iron levels. There will be a media campaign running from this month that includes advertising across print, online and mobile.

Children's supplement sales are being driven by the need for a quality supplement that children will enjoy taking and to expand on their range of popular Peppa Pig supplements, Fit Vits has launched a Thomas and Friends range of vitamins: Multivitamin Thomas Gummies, Vitamin C Percy Gummies, Calcium + Vitamin D James Gummies and Omega 3, 6, 9 Gordon Gummies. Look out for further formats coming out in the next few months, too.

The brand's Dr Tracey Long believes that pharmacies can capitalise on the products' popularity in several ways. 'We have specifically packaged the product in a weekly course, which can add incremental financial benefits to the pharmacist through regular repeat business, and after listening to pharmacists who have asked us for additional support we have developed a range of point of sale items such as brochures and holders, counter display units and posters to help pharmacies raise awareness of the product range.'

A press and digital campaign for the Rescue brand will run from the end of March to May 2014, aiming to build on key consumer insights on the Rescue brand. The campaign will be supported with in-store promotions. Nelsons UK says that further campaigns are planned for later in the year to support Rescue and Rescue Night.

Comment

Fiona McElrea, Whithorn Pharmacy, Whithorn 'This is a strong category in our pharmacy, with many patients veering away from branded products and opting for our Valupak range. We sell a large selection of these products. Popular branded products are Berocca, Metatone, Seven Seas, including Multibionta and vegetarian options, and if we can buy these at a promotional price, we pass on the savings to the customer. We supply Healthy Start vitamin tablets and drops through the Health Board. Patients on low income receive these free of charge through a voucher scheme and other customers can buy them at a locally agreed price. Patients regularly ask for advice regarding supplements.'

Fiona McElrea, Whithorn Pharmacy, Whithorn 'This is a strong category in our pharmacy, with many patients veering away from branded products and opting for our Valupak range. We sell a large selection of these products. Popular branded products are Berocca, Metatone, Seven Seas, including Multibionta and vegetarian options, and if we can buy these at a promotional price, we pass on the savings to the customer. We supply Healthy Start vitamin tablets and drops through the Health Board. Patients on low income receive these free of charge through a voucher scheme and other customers can buy them at a locally agreed price. Patients regularly ask for advice regarding supplements.'

Ani Patel, Savages Pharmacy, Burnham-on-Crouch 'We focus on this category all year round. There is stiff competition from health stores and online, but customer engagement and competitive pricing will keep this category going for community pharmacy. We stock the main brands, own brands and the HealthAid range, and this gives a degree of choice and quality for most of our clients. We have reference materials and guidance documents for our staff and customers alike. Engaging with customers is important to ensure good and safe sales of these types of products. In our experience, a good display, always topped up, ensures a decent level of sales.'

Ani Patel, Savages Pharmacy, Burnham-on-Crouch 'We focus on this category all year round. There is stiff competition from health stores and online, but customer engagement and competitive pricing will keep this category going for community pharmacy. We stock the main brands, own brands and the HealthAid range, and this gives a degree of choice and quality for most of our clients. We have reference materials and guidance documents for our staff and customers alike. Engaging with customers is important to ensure good and safe sales of these types of products. In our experience, a good display, always topped up, ensures a decent level of sales.'

William Hughes, RJ Jones Pharmacy, Nefyn 'This is definitely an important section for us and we dedicate a fair amount of shelf space to it. We've had staff training on this category and additional training quite recently as customers do come in and ask for advice about what to take for different issues. We find that there are trends in terms of what vitamins and supplements are popular, but the cod liver oils always fly out. Elderly customers in particular take it for joint suppleness. The vitamins and supplements range is clearly on display when a customer walks in so they can browse them quite easily. It's also in a place that is very accessible to the staff. Patients can help themselves to the information or staff can use the information as an aid and go through it with them. I think every pharmacy needs to be aware that vitamins and supplements do generate good sales and you can improve patient loyalty by having these products available.'

William Hughes, RJ Jones Pharmacy, Nefyn 'This is definitely an important section for us and we dedicate a fair amount of shelf space to it. We've had staff training on this category and additional training quite recently as customers do come in and ask for advice about what to take for different issues. We find that there are trends in terms of what vitamins and supplements are popular, but the cod liver oils always fly out. Elderly customers in particular take it for joint suppleness. The vitamins and supplements range is clearly on display when a customer walks in so they can browse them quite easily. It's also in a place that is very accessible to the staff. Patients can help themselves to the information or staff can use the information as an aid and go through it with them. I think every pharmacy needs to be aware that vitamins and supplements do generate good sales and you can improve patient loyalty by having these products available.'