Numbers reveal where your initial contract focus should be

In Running Your Business

Follow this topic

Bookmark

Record learning outcomes

A little over a year ago the NHS was promised an additional £20 billion funding package that amounted to a spending increase of 3.4 per cent per annum until 2023/24. In light of this, the Community Pharmacy Contractual Framework funding package announced in July, containing a completely flat headline figure of £2.59 billion for the sector for the next five years, has understandably received a mixed reaction.

But how will it affect individual pharmacies, and what do the big numbers mean for your workload and income?

Our analysts have overlaid the new contract on the historical transactions of the UK pharmacy groups, according to group size. We’ve looked at each of the headline numbers in the budget lines for prescribing and dispensing, schemes and services, and calculated the effect for average branches within these different group sizes.

Prescribing and dispensing

The headline total funding figure for the Single Activity Fee (SAF) remains unchanged, the fee per prescription item will increase from £1.26 to £1.27. We do expect fee item numbers to decline during 2019/20 thanks to several factors, including increased prescription duration and a move by GP surgeries towards social prescribing as part of medicines optimisation programmes.

Schemes and other block payments

The Pharmacy Quality Scheme (formerly the Quality Payment Scheme) and Pharmacy Access Scheme will continue in the same format with a sustained level of funding – £75m and £24m per annum respectively through to the end of the agreement period.

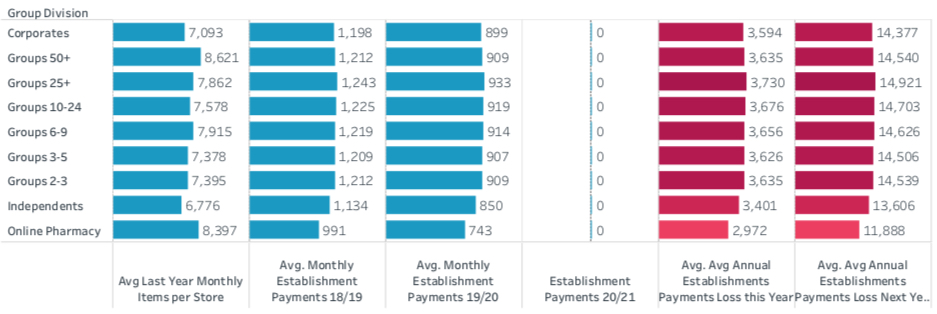

Establishment payments will end in the next financial year. For this year, the funding reduction from £164m to £123m represents a 25 per cent cut, equivalent to continuing in their present format until the end of 2019 only. Our breakdown of the loss in income by branch, which will affect groups of all sizes equally, is shown in Figure 1.

Clinical services

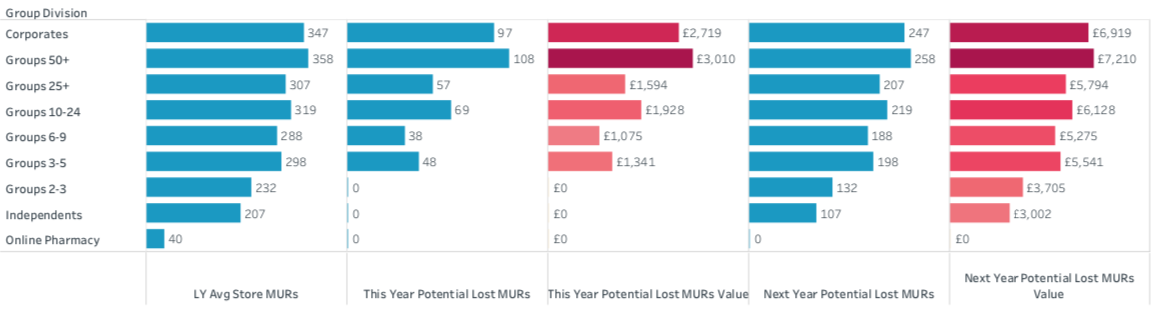

The phasing out of Medicine Use Reviews (MURs) will reduce and then eliminate this service as a source of income for pharmacy. Historically larger groups, with flexibility in resources and target driven cultures, had been the big early adopters of MURs, so they will see the biggest drop in income from this category as the cap drops to 250 and then 100 paid services in 2019/20 and 2020/21 respectively.

Our figures show the cap of 250 for this financial year will have little effect on the average pharmacy, as the majority have struggled to perform significantly more than 250 in any case. The few branches that were delivering the maximum of 400 will, however, lose £4,200 of potential revenue in year 2019/20 (Figure 2).

The phasing out of the service will deliver a dramatic dip in income by 2020/21, although bear in mind that by this stage, in theory at least, this lost income will be being made up for elsewhere, by new clinical services. The lack of detail at this stage suggests keeping an eye on any hint as to what may happen next is vital.

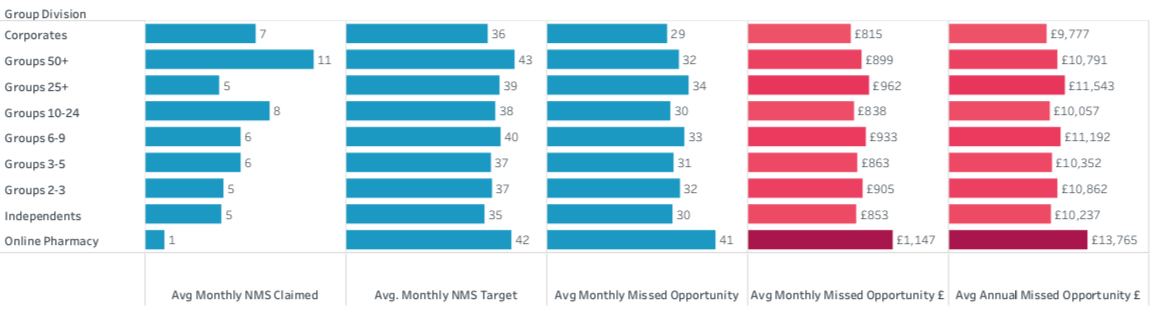

The New Medicine Service (NMS) retains its funding at the current level. This remains an available source of revenue which community pharmacy is far from maximising, especially since the cap was replaced by a calculated number of potential service episodes related to monthly prescription volume. We expect no dramatic shift in revenue from this service. Figure 3 shows income that under current market conditions should be classed as a “missed opportunity” at approaching £1,000 a month.

However, the Community Pharmacist Consultation Service (CPCS) is the major new opportunity for pharmacy being rolled out nationally. The deal projects £4m will be paid out for CPCS in financial year 2019/20 at a flat fee of £14 per consultation.

While this equates to just 285,000 services being delivered across the country in the first year, this is not unreasonable, as there will clearly be challenges getting the new service up and running at scale. The funding projection of £9m in 2020/21 anticipates the service being delivered more fully in year two, although this still only equates to just over 640,000 service episodes, or an average of just one per week per pharmacy. There is clearly a considerable potential upside here, although obviously excess episodes will come out of the transition payment pot, but pharmacies that embrace the CPCS, and are in areas that adopt it rapidly, could mitigate cuts elsewhere. Good relationships with local GPs, who will be able to refer patients for a CPCS, are worth investing in now.

Transition payments and new services

Of course, the biggest shift in the funding settlement is the movement of establishment payments into a new larger pot labelled “transition payments and clinical services”, which hints over time at a broader move from passive supporting payments resulting from meeting a very low item threshold, to more clinical activity-based programmes.

It’s not unreasonable to interpret the transition payments as a temporary measure and that, even though this funding pot is set to grow to £223m by 2020/21, we can expect this amount to be increasingly distributed as payments for clinical services over time across the five year funding contract framework period.

This represents, of course, the biggest challenge for contractors. Whilst the total funding level is confirmed for the next five years, even with no growth built in, not even for inflation, nearly 10 per cent of the funding package is earmarked for ‘services’ that don’t yet exist.

This equates to an average of £6,000 per pharmacy in 2019/20, rising to a projected £19,390 per pharmacy in 2020/21 and beyond. But with the funding criteria yet to become clear, and so much detail missing, it is impossible to assess how this may be distributed.

I’d advise any contractor to keep up to date with whatever comes out of the negotiating body – perhaps you should diarise checking for updates on the Pharmaceutical Services Negotiating Committee (PSNC) website every week, or at least every month, to be prepared to make the most of the opportunities as they emerge.

Don’t forget too, that the five year deal covers the national contract framework; any locally agreed payments for services will be additional. With the message coming repeatedly from the NHS that those who engage most proactively with primary care networks will be the best placed to co-design and win locally commissioned services, you should ensure that you keep in touch with your local representative body too.

I, like you, look forward to hearing how this engagement can be achieved.