In News

Follow this topic

Bookmark

Record learning outcomes

Integrated Care Board (ICB) regions that had the highest number of community pharmacies a year ago appear to be sustaining bigger numerical losses – but not vastly larger proportional losses – than those that had the fewest pharmacies.

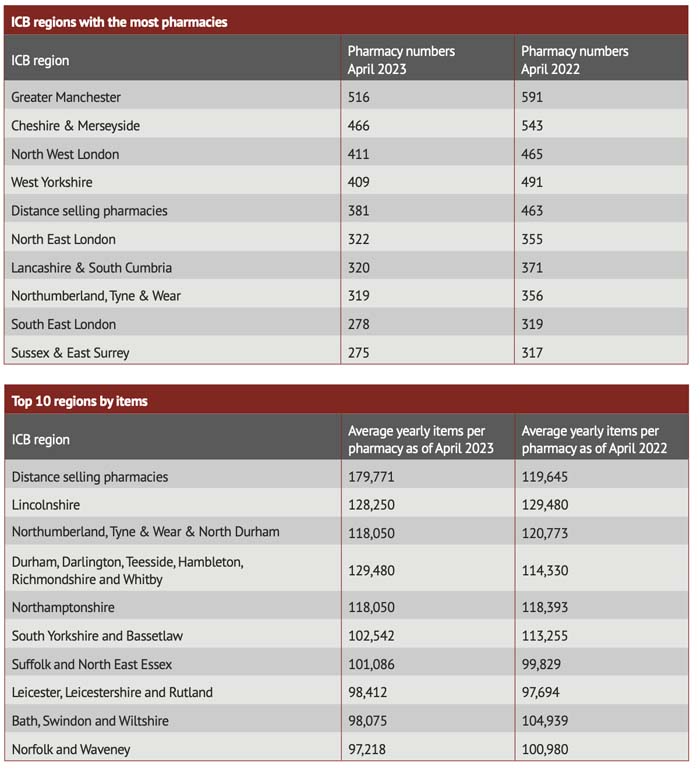

NHS BSA dispensing contractor data for April 2023, published in July, shows that Greater Manchester still has the most pharmacies of all 42 ICB regions, at 516. This is a 12.7 per cent reduction compared to April 2022, when it had 591 pharmacies.

Cheshire & Merseyside ICB has the second highest number at 466, despite suffering a loss of 77 pharmacies – 14 per cent fewer than in April last year, roughly similar to the proportion of pharmacies shuttered in Manchester.

Going down the top 10 regions, we see a similar story. South East London, ranked eighth for total pharmacy numbers, lost 41 in the 12 months to April – a 12.8 per cent reduction.

Keenly felt losses

When it came to regions with the fewest pharmacies, losses were proportionately slightly lower. West, North & East Cumbria saw an eight per cent reduction from 61 to 56 pharmacies and Shropshire, Telford & Wrekin saw a nine per cent drop, from 80 to 73. These losses may be more keenly felt by patients, given the lower starting point – and may be of concern to sector representatives and the NHS as they seek to maintain service provision.

In fact, some of the regions with the least number of pharmacies to begin with have suffered outsize losses in relative terms. Surrey Heartlands saw an 18 per cent drop from 135 to 110 pharmacies, while Cornwall & the Isles of Scilly saw a 15 per cent drop from 97 to 82. The data shows that every ICB region has fewer pharmacies than it did a year ago.

This is perhaps unsurprising, given the widely publicised closing of LloydsPharmacy’s Sainsbury’s stores and other corporate divestment programmes, such as the one recently announced by Boots. Nevertheless, it will no doubt cause anxiety among the sector’s representative bodies.

There has also been a relatively steep 17.7 per cent drop in the number of distance selling pharmacies, down from 463 to 381, perhaps suggesting that the boom in online pharmacies we saw during the pandemic has abated.

However, this has not stopped the biggest online players gaining market share mercilessly. As of April, the average distance selling provider had a yearly average of 179,771 items, up from 119,645 last year – a 50 per cent increase. Pharmacy2U is still the biggest dispenser in England, with 1.4 million items in April this year, followed by Lloydsdirect at 955,133 items.

None of the ICB regions with the greatest number of pharmacies appear in the top 10 regions by items. After distance selling pharmacies, Lincolnshire came out top on this measure with a yearly average of 128,250 items for its 103 pharmacies, a slight reduction on April 2022 (129,480 items).