In Interviews

Follow this topic

Bookmark

Record learning outcomes

Phoenix UK Group chief executive Steve Anderson is in an upbeat mood. The previous week, Phoenix had broken the news that they were to distribute GSK products again from 1 November. “We’ve been talking to GSK for a while,” he says. “As everyone knows, for the past 10 years, Phoenix hasn’t been renowned for being that big supplier of branded pharmaceuticals. We’ve been excluded from so many direct to pharmacy (DTP) and reduced wholesaler models.”

Phoenix UK Group chief executive Steve Anderson is in an upbeat mood. The previous week, Phoenix had broken the news that they were to distribute GSK products again from 1 November. “We’ve been talking to GSK for a while,” he says. “As everyone knows, for the past 10 years, Phoenix hasn’t been renowned for being that big supplier of branded pharmaceuticals. We’ve been excluded from so many direct to pharmacy (DTP) and reduced wholesaler models.”

The GSK deal comes less than a year after Sanofi announced that Phoenix would be one of two wholesalers with access to their inventory. “Sanofi was a great win for us, now of course GSK. In terms of the footprint, in terms of trying to make yourself more relevant in the market, they are really, really important,” Mr Anderson says. “It brings a lot of revenue. The main upside when you haven’t played strongly in that space for a decade is that when it comes back, you feel the whole business getting a lift. It’s great for market share, it’s great for our customers and members, because they have more choice. It’s one of those stories you wish you had every week, you know?”

Since the news broke, Phoenix staff have been hard at work, pre-selling the new arrangements through October. “We’ve started to engage with our members and customers to get a flavour of how much GSK business is going to come our way. Initial signs are promising.” Steve says the opportunity is good for existing customers, as it might facilitate some streamlining of accounts. “I can remember, 15 or 18 years ago, doing a survey in pharmacy on the average number of wholesalers per account in the UK, and I’m sure the answer was 1.8. Now I think it’s 3.9. The more you’ve got, the more you can be that one stop provider because the breadth of the proposition becomes one that is more akin to what you would associate with a full-line provider.”

These are clearly big deals for Phoenix, and are the visible results, he says, of a change of approach. “Since 2007 there has been an element of learning to live without those branded deals,” Steve says. “But in the past couple of years our approach has been that upstream customers are exactly that, customers. We’ve built a much stronger dedicated pharmaco team and we’ve tried to do what we should as a full-line provider, which is to span the gap between upstream and downstream requirements.”

Being part of a pan-European group helps, he says. “Now our proposition to pharmaco is much stronger, and when you’re speaking to them these days, they want to speak about pan-European deals. Easy to talk about, and exceptionally difficult to land, but they want to speak to a player with a European footprint and a consistent approach.”

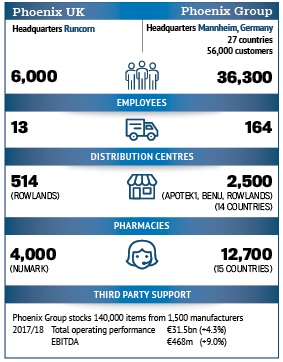

Initial success follows a strategic review over 12-18 months of a business that historically has comprised a number of related, but distinct entities, including distribution (Phoenix Healthcare Distribution and PSUK), a pharmacy chain (Rowlands), a third party service provider (Numark) and a number of smaller related businesses. “Broadly speaking Phoenix has been a £1.3bn organisation for a long time. The revenue number hasn’t really moved, which tells you that you’re not outperforming the market. And if you’re not outperforming the market when times are tough, the business gets to a dangerous place pretty quickly, right?”

Aspiring to the power of two

The result has been a new challenge for the business, one Mr Anderson says is partly thanks to treating the headline revenue figure as a ‘vanity’ number. “If we were genuinely punching our weight, and accept the fact that we are coming from third place, why wouldn’t we have aspirations, to be £2-2.5bn?” The company’s ‘Fit for 2’ programme is designed to shape the organisation internally to reach that revenue target. “It gives everyone something to hang on to, and it lets you get more people engaged,” he says.

Internally, then, the organisation has changed significantly. Seven combined back office functions, including HR, finance and IT now work across the group, supporting three customer facing business units: Phoenix, serving community pharmacies, dispensing doctors, hospitals and manufacturers; Rowlands; and Numark. They can now focus on customers, and spend less time on internal operations and admin.

“We were keen to ensure we did nothing to upset the brands,” Steve says. “So if we’ve done that in an invisible way to the market, we’ve probably done that quite well. There’s been a lot of change, hopefully for the better, and certainly in terms of pace, and responding to the market.” Early signs are good. “You start to get nice business development coming through, and it gives you a feeling that this is starting to work.”

Something definitely seems to be working at Numark. Mr Anderson says just two years ago, Numark had 2,500 members, now they’re just about to break through the 4,000 barrier. “Again, we’re just trying to make ourselves more relevant and punch our weight in the market,” he says, putting the growth down to better utilising the power of the Phoenix group and losing the silos. “Once you change the organisation to be more group focused, Numark gets an enormous benefit from a pharmaco win. When the two heads that manage those businesses work together to get the right commercial outcome for the customer, the member and the group, by definition you get much better outcomes.”

This brings organisational confidence too. Historically, he says, Numark was deemed the wrong partner for regional multiples, those with 30 to a 100 pharmacies. Mr Anderson sees it differently. “When you look at the overall service proposition of Numark, it’s genuinely trying to be a virtual head office in these ridiculously difficult times for pharmacy. If ever there was a time for pharmacy to cut its cloth appropriately, and look at its own back office costs it’s now. We have targeted that part of the market quite strongly, and of the 1,000 or so new members, roughly 50 per cent of our growth has come from larger accounts. And I think the proposition works very well for them.”

Local is local across Europe

Phoenix has been part of a wider pan-European group for more than 20 years. Mr Anderson says there are some overarching elements to strategy, but business in Phoenix is local. “When you present your strategy for the next, let’s say, two to five years to the Group in Mannheim, then if it’s agreed, that is the UK strategy.” It’s not like other corporates. “When we present to the Phoenix executive board in Mannheim, our single shareholder, Mr Merckle, is in the room, so you have an interesting dynamic.”

There is an assessment of strategic fit with the rest of Europe, Steve explains. “We try to have as much consistency as possible with things like branded pharma. Because they are global or European players, it’s important they feel some consistency. However, the pharmacy market in the UK is the pharmacy market in the UK; it would be preposterous to try and implement French, German or Spanish models in the UK, because they are so fundamentally different.” Matt Hancock, take note.

There is an assessment of strategic fit with the rest of Europe, Steve explains. “We try to have as much consistency as possible with things like branded pharma. Because they are global or European players, it’s important they feel some consistency. However, the pharmacy market in the UK is the pharmacy market in the UK; it would be preposterous to try and implement French, German or Spanish models in the UK, because they are so fundamentally different.” Matt Hancock, take note.

So how involved is the corporate headquarters in Germany in what is going on in the UK? “Government intervention, and changes to funding, are not peculiar to the UK,” Steve says, “however, the last year to 18 months has come as something of a shock in terms of how Draconian the changes have been.” He says that trying to come up with reasonable answers for a shareholder in a different part of Europe as to why there has been so little dialogue with Government during such a contentious period has at times been tricky. “Yes, it’s been very surprising for the board, and very difficult. It can feel like you are just springing surprises, and in part that is because there has been very little negotiation.”

The challenge is simple. “We want to make some large capital investments, whether that’s around centralised dispensing, or how our pharmacy network looks, or the size and shape of our wholesale distribution network. We have an enormous amount of investment to make to be GDP [good distribution practice] compliant, top to bottom. You are looking to your shareholder for multiple millions, and they are looking at the market and thinking ‘hmm’. When you put all those things together, and you have Brexit looming in the background, it [the UK] is not an easy market to invest in currently. Would you be prepared to write a cheque for a vertically integrated pharmaceutical provider in the UK right now? It’s not an easy decision.”

In terms of the sheer volume of intervention, the UK stands out, Steve says. “I am convinced that in most European countries they would have downed tools by now. Though there are other countries where it is equally difficult in terms of margin.” Phoenix operates in 27 countries across Europe, and holds a market leading position in 14, including in its home market of Germany. “They have just bought a large organisation in Romania, and I think they will continue to invest in markets where they think it makes sense.”

Government intervention has made life difficult for Rowlands

The interventions by the NHS in England have certainly had a major impact on Rowlands, Phoenix’s UK chain. Mr Anderson is refreshingly frank. “The honest answer,” he says in response to the question, “is that if Rowlands wasn’t part of a much bigger UK group, its current position would be exceptionally precarious. The impact of Government intervention in the past year or so has made life in Rowlands exceptionally difficult.” He’s read articles about appropriate staffing, and says everyone has to cut their cloth. “Our approach is to make some relatively large investments. We have a pouching facility around the corner, called NuPAC. It felt a bit risky to be honest,” he says. “In Europe, pouching is the norm, but in the UK, you are going to have to change the model. And if you cross that threshold, then you stop offering trays.” Early feedback from the PilPouch system is “extremely positive”. Steve says that for patients who are still mobile, convenience wins. For Phoenix, the system offers speed, volume, and managing complexity, while continuing to improve safety. The alternative, automating trays, is not easy. “Win, win”.

Mr Anderson is particularly enthusiastic about dispensing into pouches, which is also known to be popular in the Department of Health as an alternative to monitored dosage system (MDS) trays. “Everybody has a chance to do it,” he says. “We’ve got a facility around the corner, but at the Pharmacy Show I was looking at a machine no bigger than a flipboard. It’s not like you’ve got three or four players in the UK, trying to get each other’s dispensing. It’s available to a single independent operator who has a few patients on trays.”

Other developments are in train. “We are building a 30,000 sq ft offsite automated dispensing facility in order to satisfy Rowlands’ repeat dispensing demand. By spring of next year, we will have 25-30 million repeat prescriptions coming through this depot [in Runcorn],” he says, adding that while the moves are partly to help with the cost base, they are also designed to break the link between volume and cost. “Wholesale businesses have been automating for 20 to 30 years. When wholesale businesses win volume, the network gets more productive, because 75-80 per cent of that new volume is handled by various forms of automation.” Steve adds that they are also forward looking to a more service-based contract. “Let’s hope so,” he says about the prospect, “they are definitely not going to pay for dispensing. That’s clear. To go on about the importance of dispensing is folly.”

He says the solutions they are building are not just for inhouse use. “We are genuinely happy to share. When we look at offsite dispensing generally, we are starting to partner with an automation supplier so we can provide Numark badged solutions to single shop operators, regional multiples and for exceptionally large, almost national, operators. We have large customer members who would like to step over that threshold. They are members; we should try to help them get there. If it does become three big players, we will come up with a model where you feel like a shareholder. If it grows, everybody will win. Otherwise it feels like somebody is always trying to take your crown jewels, right?”

The way NCSO works has fuelled suspicion

One area crying out for a collaborative approach to creating better outcomes is the long-standing problem of medicine shortages, just one issue among several that makes reimbursement a seemingly intractable problem. “I’m guessing Mr Oldfield [Steve Oldfield, chief commercial officer, Department of Health since October 2017] will have rocked up expecting to work on the PPRS [the Pharmaceutical Price Regulation Scheme, which regulates branded medicine prices] and will have been completely sidetracked by NCSOs,” Steve says. “It was an enormous issue around the end of last year and it needs to be resolved.”

There are clearly no easy answers. “I welcome the changes they have made in looking towards manufacturers for pricing rather than wholesale,” he says. “NCSO (no cheaper stock obtainable) has created suspicion, distraction and a lot of financial pain.” He fiercely defends full-line wholesalers actions in the market. “If you look at the total number of WDAs [wholesale dealer’s authorisations] in the market, compared to the number of WDAs held by HDA (Healthcare Distribution Association) members, there is a significant gap. At a recent HDA business day I told the Department of Health that if they wanted to audit the system, I was quite happy to go first. If you think national full-line wholesalers are creating the NCSO problem, then I am very happy to have a very open conversation where we can see exactly what is happening. I made the offer then and I’m happy to make it again.” He laughs when asked if he’s had a response. “No.”

He says the NCSO concession does illustrate the fragility of the supply chain. “You have relatively large generic manufacturers with outages, or ingredient problems in the Far East that are impacting supply,” Steve says. “Guess what? All the main players in the supply chain have had, will have going forward, some outages. If one of the three or four major generic suppliers has a major outage, then you can see how difficult it is for the other two or three to pick up the slack.”

He believes there is greater recognition of the fragility of the supply chain than in the past. “We tried to lobby through HDA, but I still think there is an underlying belief that there is more flexibility in the supply chain than there actually is. Is the understanding better? Yes. Is it where it needs to be? No.”

He uses Brexit to illustrate his point. “Stockpiling for Brexit in standard wholesale distribution? My view is it can’t take six weeks stock. There may be pre-wholesaling spaces that can take it, but in wholesale we are wound very tightly, and do a remarkable job – the same thing every day – but when there is a bump in the road it is very difficult to recover. There’s not as much product in the supply chain as people think. On fast moving ethical product there is probably no more than 12, 13 days stock,” he says. Product comes into the UK every day. “The majority are ethical prescription products, probably 75 to 80 per cent of it is on a weekly delivery. It’s not like we get a delivery and that’s us for the next three months.”

He sympathises with contractors. “It’s been so painful, things that should be easy, quotas etc, and they are already unbelievably busy.” He does think there may be upsides from the implementation of technology in dispensing. “Once you have more centralised dispensing, regardless of where it is, then there is a much better pool of data; access to product becomes straightforward if you decide to share that upstream.”

As for preparedness for Brexit? “It’s difficult to know exactly how this is going to play out. We move a lot of product back and forth. Will the borders be open? Nobody knows, right? In the short to medium term, we feel we are relatively well prepared on a pan-European basis. We have some contingencies in place, we will do everything we can to be prepared across the supply chain.” Timing could be better too “It’s unfortunate that it comes at the same time as we’re implementing FMD [the Falsified Medicines Directive]; it’s a perfect storm in that regard. But we are preparing for FMD and we’re preparing for Brexit.

The impact of Brexit on the UK’s compliance with FMD has also recently been put into focus by statements from Department officials. What’s Mr Anderson’s view? “The Swiss asked a question. Post FMD and Brexit, will we have access to the European database, and the technically correct answer is ‘no’. The very worst outcome is you will have access for six weeks, at which point we’d be removed from the databases, and from my understanding you wouldn’t be able to decommission. I’m guessing dispensing life in the UK carries on as normal, but you can’t decommission product.

“I think PMR providers will be ready, that’s clear. On a pan-European basis we are broadly ready. It’s not our plan on day one to have all 514 Rowlands stores kitted out and ready to go. We will have an all nations selection of stores ready and trialling, making sure, and we will phase it in over the coming months, but from an IT perspective, we’re ready. We’ve got a working party that’s been working on it, and the same thing across 27 countries in Europe.”

Fresh dialogue, green shoots

Over the past couple of years Mr Anderson has not been slow in sharing his views on the funding cuts in England. He’s not stopping now. “There are some green shoots. We have come through a difficult period, but there appears to be some fresh dialogue, which is more forward looking.” He notes the words of new Health Secretary Matt Hancock that ‘pharmacy will get its share of the £20bn’. “Even that is an enormous change from the last 12-24 months, which has been to keep turning the tap off.”

He recognises the innovation taking place at a local level, and thinks collaboration with other providers is important. “We are ridiculously slow at coming together,” he says. “Even across HDA there are value adding things we don’t share. We’re all trying to be GDP compliant, we should be collaborating to be better, instead of competing on silly things. Collaboration on better outcomes, fundamentally everybody wins, right?”

He feels the NHS in England still sees pharmacy as an outside player. “Until we have a contract where pharmacy is fundamentally part of the NHS, we will continue to be marginalised. Pharmacy has got so much to offer, but until we move to a model where you are directed to a pharmacy for services you cannot get from other parts of the NHS, we remain in a precarious place.” He remains optimistic. “It’s been a dark 12 months, but there is hope on the horizon.”

Major career highlights?

Steve: The first time we got a full line national wholesaler completely ISO9000 compliant, top to bottom. There was recognition that the world was going to change, and that wholesale needed to be brought into the 21st century and it needs to be able to guarantee quality. It was a gargantuan effort at the time to get over that threshold, and I was a part of that team. It was a big step forward.

More recently, watching the first automated dispensed product popping out the end of the machine. It took two years from start to finish, so that was a big thing. Some people won’t like that, but that’s where we are.

What gets you into work in the morning?

Steve: I love it. The group has got so much opportunity. We’ve worked exceptionally hard to be more relevant in the market, upstream and downstream, the 50 per cent Numark growth, the GSK win, the Sanofi win, we’re working through a big change programme; it’s easy to be motivated to come to work for that.

What keeps you awake at night?

What keeps you awake at night?

Steve: The pharmacy contract. I am naturally optimistic, and I do have an optimistic view that the pharmacy contract will bring about the sort of change the sector deserves. And it definitely deserves it. It would be fabulous to see it as a fundamental part of the NHS. And it could be, and it could add so much more value than it does today. But if that negotiation doesn’t come off in the way that we hope, let’s not talk about that.

Do you have any unfulfilled personal ambitions?

Steve: My wife and I have always said we are going to do Everest base camp, and we are planning to do it in two years’ time. Whether it happens remains to be seen; I need to get some training in! Work ambitions will be to see out our mid-term plan, and to be a profitable £2bn organisation.

How do you relax?

Steve: I love to play golf although I don’t play so much these days. I used to do a reasonable amount of running, but golf’s a Sunday morning thing these days.