UPDATED: new contract analysis

In Pharmacy In Practice

Follow this topic

Bookmark

Record learning outcomes

On one page: the headline and immediate analysis of the five year agreement announced by the Pharmaceutical Services Negotiating Committee.

First thoughts from P3pharmacy's editors

Representative comment from NPA, CCA, RPS, McKesson UK, Phoenix UK

Front line opinion from Dorset contract Mike Hewitson

Our anonymous community pharmacist takes a positive view of the last chance saloon

More detail needed but the numbers show where to invest, says RWA's Paul Counter

FUNDING

At a time when community pharmacy is facing increasingly difficult times, the funding package is of crucial importance to contractors.

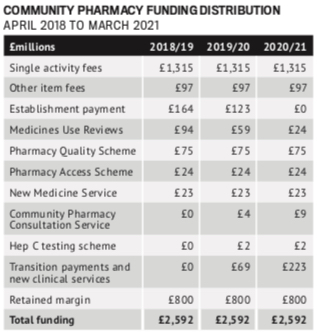

Total funding is £2.592 billion per annum for five years from 2019/20 to 2023/24. This is also the same total as 2018/19.

Total funding is £2.592 billion per annum for five years from 2019/20 to 2023/24. This is also the same total as 2018/19.

- The split between margin and fees remains at £800m and £1.792 billion respectively

- Funding distribution will be agreed on an annual basis

- The funding model will be reviewed — the balance is likely to shift towards the delivery of services.

- Category M reimbursement prices will increase by £15 million a month from August 2019. The single activity fee will rise by 1p to £1.27 per item.

- Establishment payments will be phased out over the second half of 2019/20. No payments, or lower payments, are expected to be made from April 2020.

- Monthly transition payments will be paid from October 2019 to March 2021. These will be linked to dispensing volumes in an as yet unspecified way.

- The Pharmacy Access Scheme (PhAS) funding continues at £24m until April 2020. Reimbursement arrangements will be improved to deliver smoother cash flow and fairer distribution of margin.

P3PHARMACY COMMENT

While a 5-year static funding deal may provide certainty, it creates neither the obvious resources nor the necessary enthusiasm required for transformative change.

The loss of the automatic establishment payment means that while the funding is retained, contractors will need to do more to earn it back. It does however, remove one line or argument from anti-pharmacy hawks, that pharmacies are paid “just for being there”.

PHARMACY QUALITY SCHEME

The Pharmacy Quality Scheme (PQS) – the new name for the Quality Payments Scheme from October 2019 – will be worth £75m in each of the next five years.

It will help to underpin a contract which focuses on services. An ongoing programme of activity will ensure that community pharmacies deliver health benefits to patients.

New requirements (in addition to the current ones, which will become Terms of Service requirements from April 2020) are:

- Preparation for engagement with primary care networks (PCNs)

- Medicines safety audits including: safe prescribing of lithium; advice on pregnancy prevention for women taking valproate, and a re-audit of the appropriate use of NSAIDs

- Checking whether patients with diabetes have had annual foot and eye checks

- A reduction in the volume of sugar sweetened beverages (SSB) sold by the pharmacy to 10 per cent or less

- Completion of training and assessment on ‘look alike, sound alike (LASA) errors, including an update of the pharmacy’s patient safety report and evidence of action

- An update of previous risk reviews

- Completion of sepsis online training and assessment, with risk mitigation

- Completion of a dementia friendly environmental standards checklist

- To further boost cashflow, up to 70 per cent of QPS earnings available upfront as an ‘aspiration’ payment, subject to meeting gateway criteria

P3PHARMACY COMMENT

The PQS is critical to ensure the safety, quality and consistency of clinical services. The elements of the new PQS reflect wider NHS and societal priorities, making community pharmacy a part of mainstream delivery. They also reflect a mainstreaming of models which have been tested in the past – the Community Pharmacy Safety Group has conducted valproate and lithium audits, for example. Sepsis awareness has been promoted by multiples and the NPA, as well as by P3pharmacy and our sister titles.

SERVICE DEVELOPMENTS

Announced as a contract that is more focused on patient care services, a raft of them are planned over the next five years:

- A palliative care medicines service

- Point of care test and treat for common ailments

- A hepatitis C service (until 2021)

- New Medicines Service expansion

- Hypertension and atrial fibrillation (AF) case finding implementation.

MURs to be phased out

- In 2019/20 contractors can deliver a total of 250 MURs. In 2020/21 this will reduce to 100, with the service being decommissioned at the end of that year

- Contractors can provide an additional 50 MURs during the second half of 2019/20 if they have already provided 200 MURs in the first half

- All contractors can provide 250 MURs in total throughout 2019/20, but no more than 200 in the first half of the year.

Community Pharmacist Consultation Service (CPCS) – NHS 111 and GP referrals

- The CPCS brings together the NHS Urgent Medicines Supply Advance Service (NUMSAS) and the local pilots of the Digital Minor Illness Referral Service (DMIRS)

- CPCS will take referrals from NHS 111 and will expand over the five years to include referrals from GP practices, NHS 111 online, urgent treatment centres and possibly A&E

- Contractors who are ready to to provide the service from 1 December 2019 can claim a £900 transitional payment. Those who are ready by 15 January 2020 can claim £600

- There is a £14 fee per completed consultation.

Medicines reconciliation service

- Will be introduced in 2020/21 to ensure that changes in medicines made in secondary care are implemented appropriately when the patient is discharged back into the community.

Other activities

- Stop smoking support referrals from secondary care

- All pharmacies to be Healthy Living Pharmacies by April 2020.

Future services

- Extension of the reach of the six annually mandated public health campaigns, using digital resources

- Routine monitoring of patients, for example those taking oral contraception, supplied under an electronic repeat dispensing arrangement

- Activity to complement forthcoming PCN service specifications, for example on early cancer diagnosis and tackling health inequalities.

P3PHARMACY COMMENT

The loss of MURs has been widely trailed. They never evolved from 2015, and anecdotally they are of variable quality, which is almost the same point. With clinical pharmacists in general practice and PCNs going to be delivering structured medication reviews, they were surplus to requirements. At least the funding is being recycled into different services, but the lesson from the MUR experience is that delivery, quality and patient outcome are important. It may be that pharmacy needs to look again at the New Medicines Service, which has a very clear evidence base, to ensure that any additional therapeutic areas added in are joining a service that is subject to a continuous improvement cycle.

FUTURE DEVELOPMENTS

PSNC has agreed to have discussions with DHSC and NHSE&I on how best to commission IT in community pharmacy and to explore ways to make dispensing more efficient, to free up pharmacist and pharmacy team time and capacity.

Topics to be covered include:

- Legislative changes to allow all pharmacies to use hub and spoke dispensing

- Use of original pack dispensing

- Legislative changes to facilitate better use of the skill mix in pharmacies

- Funding models

- Support for contactors wishing to consolidate their businesses

- Removal of redundant administrative requirements (e.g. by simplifying endorsing).

P3PHARMACY COMMENT

There’s a lot of work in here but there are probably some potential upsides in an otherwise flat funding package that will be eaten away by inflation and the inevitable cost pressures that will accrue over five years in most service businesses. There’s some long-standing irritants, like part pack dispensing, that might finally achieve some resolution – OPD was due to be implemented as long ago as 1992 – but there’s lots of detailed work needed. Five years might not be enough.

LINKS

First thoughts from P3pharmacy's editors

Representative comment from NPA, CCA, RPS, McKesson UK, Phoenix UK